Also, factoring companies can help businesses with scalability needs. This makes it easier to comfortably offer payment term options to clients without worrying about stifling cashflow.Ĭompanies that have the ability to offer financing or delayed payments have more growth capabilities. A business owner receives quick cash, and the company that factors the receivables waits for the customer payments to arrive. With factoring, business owners have the option to factor invoices quickly after the services or product orders are fulfilled and the invoices are issued. If the potential clients both promise loyalty to the business, not offering payment terms means that the clients will likely look elsewhere. To better understand this, consider a government client that is adamant about having a 60-day payment term and a commercial client that demands a 30-day payment term. Customers are more likely to make purchases when they feel comfortable, and a delayed payment may be easier for many clients to handle for a variety of reasons. While offering one credit option to clients is great, offering two or more payment term choices is ideal. Today, many companies lose potential customers to competitors because they lack the ability to extend credit terms.

How An Invoice Factoring Company Helps Businesses Offer Customer CreditĪ benefit that is big enough to warrant a more thorough explanation is customer credit flexibility. Also, small business owners find that it normally costs less to use factoring instead of trying to put expenses on business credit cards. It is difficult for small businesses that are newer and have lower annual revenue to qualify for conventional loans or lines of credit. Selling equity during a cash crisis can be a detrimental choice for a business on a long-term basis.ġst Commercial Credit is a factoring company that helps out small business with minimal sales volume. By using receivables factoring instead, business owners can protect their equity and get through temporary cash shortages. While some business loans provide cash based on equity, using them is like starting over and losing part of an investment. Using a factoring company to finance invoices only encumbers accounts receivable as collateral and minimizes the risks of losing equipment, or inventory not related to the invoice or real estate assets.Īlso, there is no need to give up equity. With conventional business loans, all business assets are used as collateral.

#Invoice factoring service full

Although it is not necessary to report, it is prudent to add information about the factoring arrangement in the balance sheet footnotes to provide full disclosure if your company is public. Since factored receivables are considered contingent assets with financing that is secured from non-lender and non-investor sources, factoring is an off-balance-sheet form of financing. Many business owners are hesitant to add more debt that must be reported on the balance sheet. Our average client pays an average discount fee of 2.25% depending on the days outstanding the invoices pay. 1st Commercial Credit offers very low rates between 0.69% to 4%.

The rate is usually reasonable for the structure of the arrangement.

#Invoice factoring service free

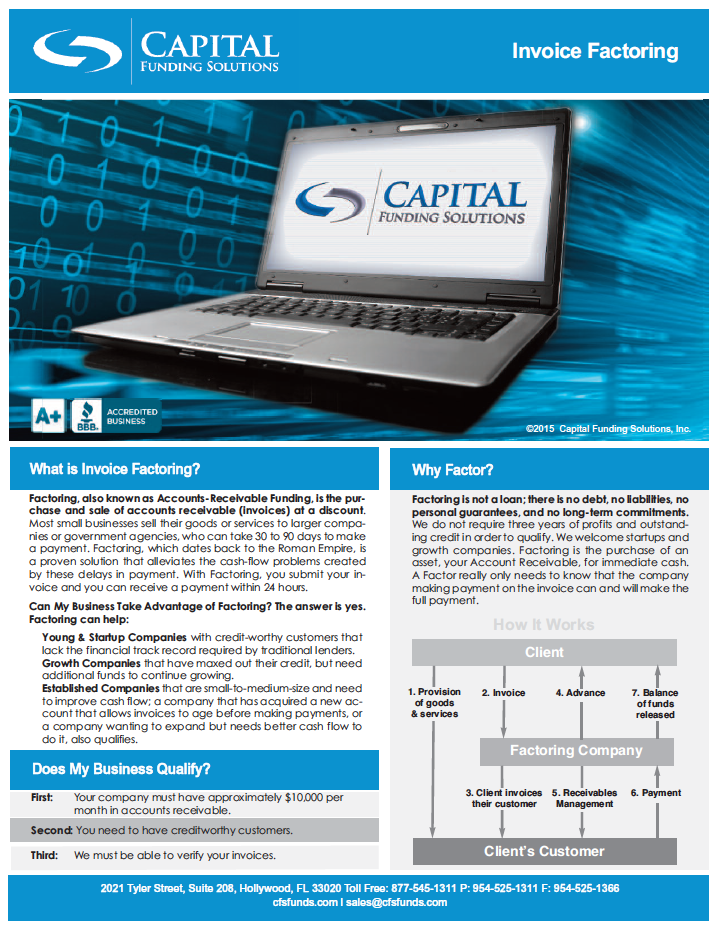

As long as a business has been in operation, meets revenue requirements and is free of liens or legal issues, approval is likelier. It also helps to have creditworthy customers. The documentation requirements are not as lengthy, and the main requirement is that an applicant has invoices for work or orders that have already been satisfied. In comparison with a traditional bank loan, companies that factor receivables have quicker approval process. 1st Commercial Credit is a factoring company that specializes in evaluating accounts receivable and can make a prompt approval decision. It has become a simple, fast and easy way to access business cash flow. We leverage your credit eligibility based on your buyer's credit quality, not your company.Īn accounts receivable factoring service converts invoices sold on credit terms for immediate working capital. Factoring is not the same as a bank loan. Having a simplified option for getting cash is the biggest benefit. Benefits of Using Invoice Factoring Companies We provide fast funding, flexible approvals even if the owner has bad credit, affordable rates and other financial solutions that help grow companies. Our receivable factoring services allow our customers to offer credit terms to customers without running into cash flow shortages.

0 kommentar(er)

0 kommentar(er)